Find the right small business loan

Maximize your CEBA loan forgiveness credit by Jan 18, 2024 and reduce the amount you pay to borrow money for your small business.

Take Advantage of CEBA Loan

Forgiveness Credit

for Maximum Savings!

Forgiveness Credit

for Maximum Savings!

If you don't have the free cash to pay back the required principle to maximize your loan forgiveness credit—that's ok!

Levr.ai is already working with small businesses to secure funding to pay back as much as possible by Jan 18, 2024 so you can max your forgiveness credit and reduce your overall borrowing costs.

Below are two scenarios calculating the cost to borrow $60,000 via CEBA.

No CEBA payback

$69,457

Borrowing cost of $9,457 on a $60,000 CEBA loan that is simply converted into the available 3-year loan at 5% interest per annum.

______________

$60,000 - CEBA loan

$9,457 - loan interest

$69,457 - total

Max CEBAforgiveness credit

$47,927

Work with Levr.ai and borrow $40,000 to pay back your CEBA loan and maximize your forgiveness credit, with a new 2-year loan at 18% interest per annum.

________________

$60,000 - CEBA loan

$20,000 - forgiveness credit

$40,000 - new loan

$7,927 - new loan interest

$47,927 - total

Amount of savings is subject to loan approval and loan terms. Applicants with strong credit and business financials may qualify for a better interest rate for even more savings.

Lower the cost of borrowing on your CEBA loan

Levr.ai can help you explore how you can borrow the minimum amount required to pay back your CEBA loan by Jan 18, 2024 and be eligible for the maximum loan forgiveness value.

Talk to a Levr.ai lender expert for free today, and see what your options are to lower the overall cost of borrowing through CEBA.

Connect with dozens of trusted and certified lenders

Why so many small businesses choose Levr.ai?

21.6K

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat.

Active Customers

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad.

The reality is that many small businesses cannot always look to their bank for funding. And that's okay!

Levr.ai has partnerships with dozens of certified lenders who can closely evaluate your business and provide you with a wider range of funding financial tools to secure the capital you need to meaningfully grow your business.

Our certified lenders take a deeper dive into your goals, financial forecasts, and the ever-changing marketplace in which you compete.

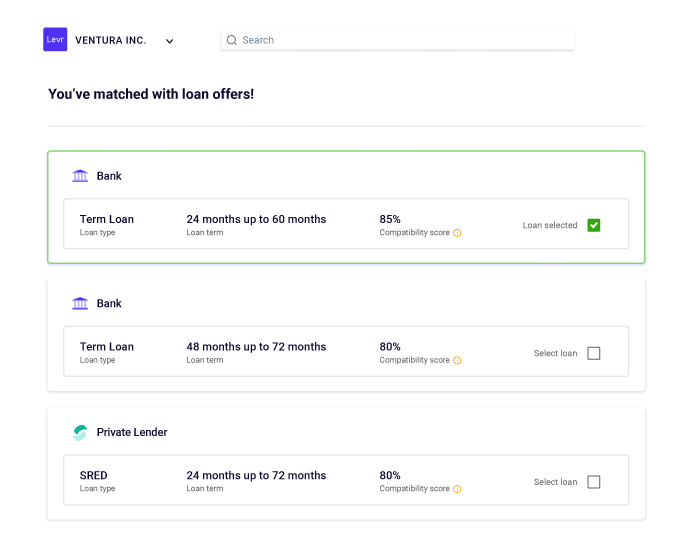

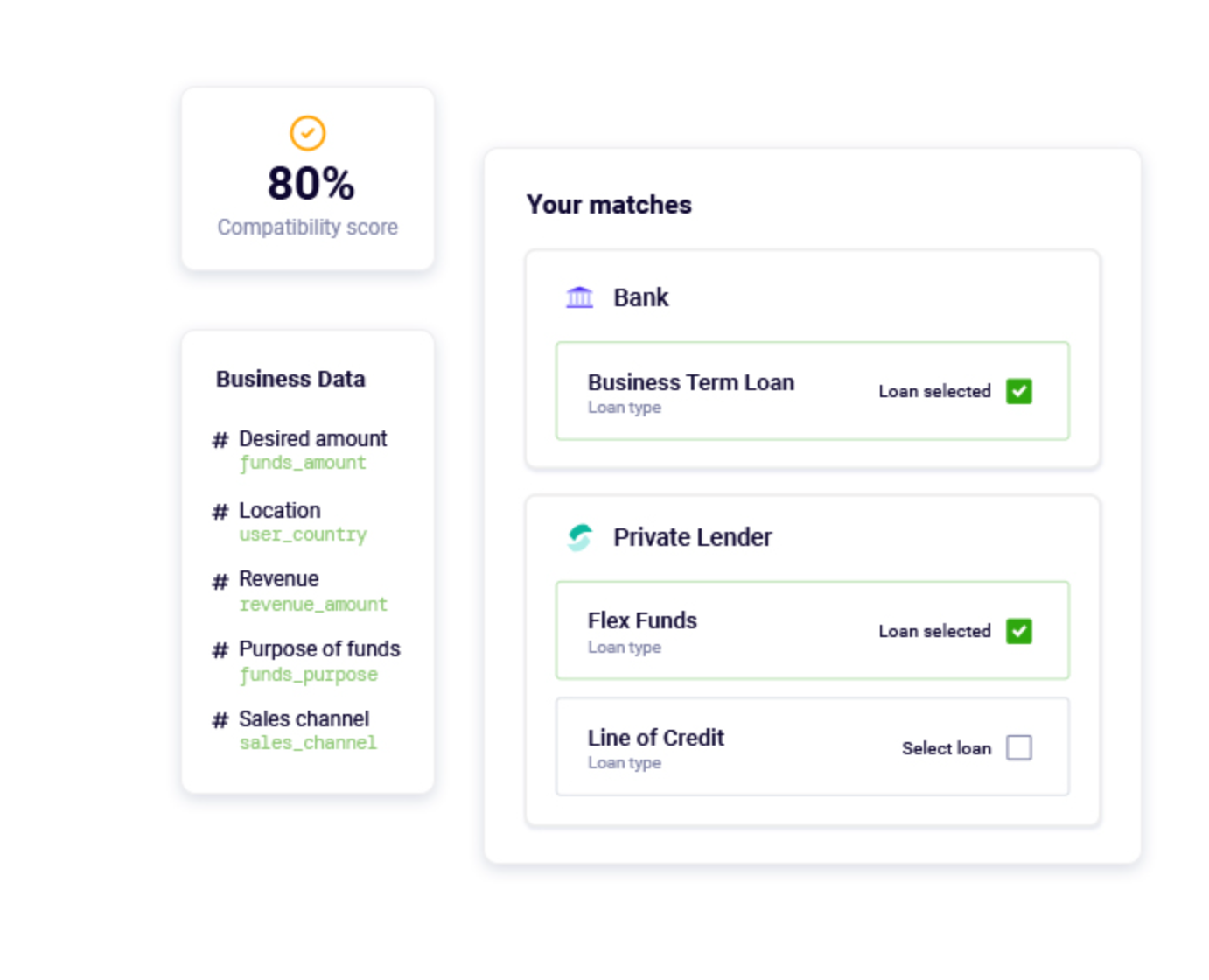

Levr.ai harnesses the power of AI for custom funding options

21.6K

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat.

Active Customers

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad.

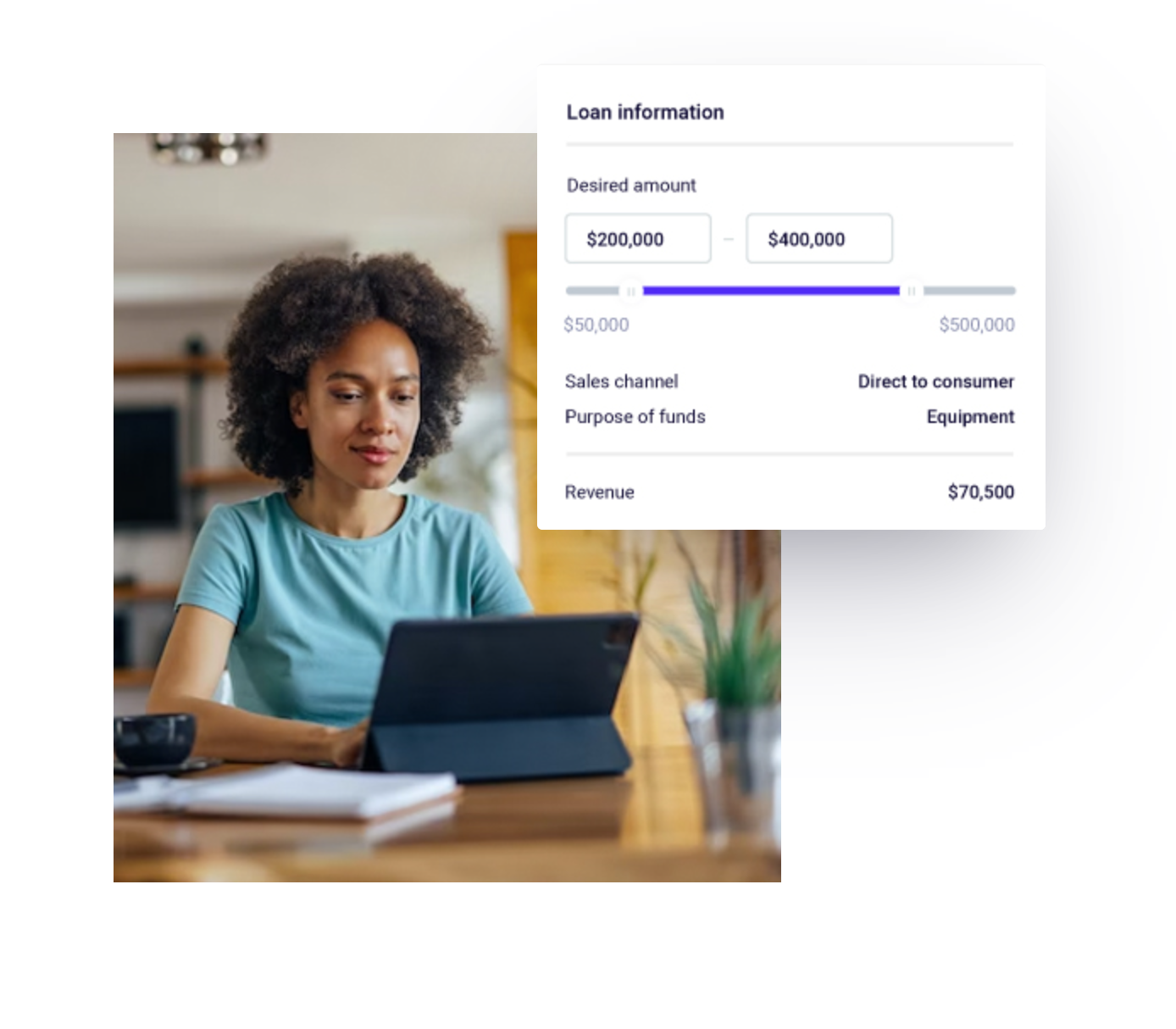

Levr.ai uses AI to customize loan matches based on your businesses needs.

You're always in control, and Levr.ai's free intelligent loans platform allows you to securely and safely evaluate all your funding options.

You decide what is the right small business funding option for you, and when to engage with our certified lending partners.

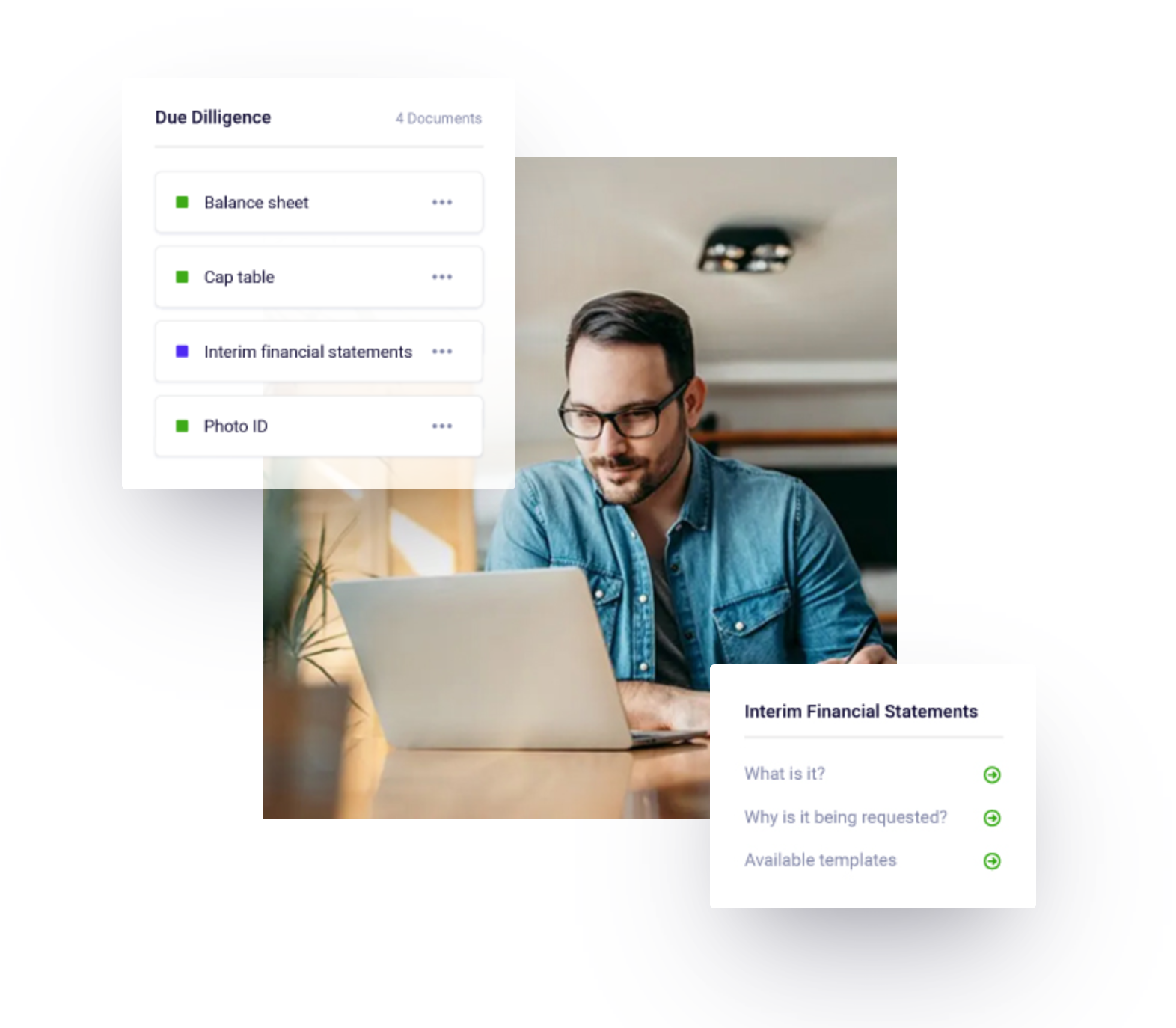

Levr.ai makes it easy to apply for small business funding

21.6K

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad, nam no suscipit quaerendum. Et has minim elitr intellegat.

Active Customers

Et has minim elitr intellegat. Mea aeterno eleifend antiopam ad.

An intelligence loans platform with an easy-to-use dashboard, Levr.ai provides custom funding matches so you can see all your options and secure the right funding to meaningfully grow your small business.

With its free expert team to review documents and help prep a strong loan application, Levr.ai makes it easy to secure small business funding—fast!

What small business customers are saying:

Plaid Analytics

Andrew Drinkwater, President & Co-founder

“Levr.ai helped us discover options we didn’t know existed, ensured our documentation was complete, so we could be successful on our first try.”

Momentum Dash

Levi Bucsis, CEO & Co-founder

“Levr.ai made getting our business loan a smooth and quick process.

We have big goals for the next year, and Levr successfully helped us secure the right financing our business needs for continued growth.”

Pyup.io

Justin Womersley, CEO & Co-founder

“The process from start to finish exceeded expectations. We had a bunch of loan options to consider thanks to Levr.ai.

In tandem their ability to organize our documentation and application made all the difference in our fast approval.”

Sam Smith

Marketing Manager

Unbounce Smart Builder is awesome! It uses AI and ML to create landing pages built for conversion. I recommend it to every marketer I know and they're as excited about it as I am!

FAQ's

What is CEBA, or a CEBA loan?

CEBA was a government program introduced by the Canadian government in response to the COVID-19 pandemic to provide financial support (through loans) to eligible Canadian small and medium businesses. It offered interest-free loans of up to $60,000 to help small businesses cover their operating costs during the economic downturn caused by the COVID-19 pandemic.

CEBA is administered by Export Development Canada (EDC), which worked closely with Canadian financial institutions to deliver the loans to their existing business banking customers.

Can I still apply for a CEBA loan?

No, as of 2022 your business cannot get a CEBA loan. The Canadian government closed the application period for the CEBA on June 30, 2021 and the funding period has now ended. As a result, no applications can be submitted, and no new funding will be provided by the CEBA Program.

The Canadian government has said CEBA eligibility criteria validations are complete for all applicants and the results of these validations are final.

Is the government extending the payback date for CEBA loans beyond December 31, 2023?

Yes! In September 2023 the Canadian government announced an extension on the CEBA payback date from Dec 31, 2023 to Jan 18, 2024. While many business owners were hoping for more time, this is likely the LAST and FINAL extension the Canadian government is going to make.

There are a number of groups lobbying for an extension, like the NDP of Canada and Canadian Federation of Independent Business (CFIB) to name a few.

The Canadian government extended the payback date for CEBA loans, in 2022 to the end of 2023 demonstrating their understanding and empathy towards the challenges faced by small businesses during the COVID-19 pandemic. While another year has quickly passed and there are a number of small businesses across Canada hoping for another (unlikely) extension.

What is the CEBA loan forgiveness and do you qualify?

The Canadian government is extending up to 33 percent (or up to $20,000) loan forgiveness on outstanding CEBA loans of $60,000. If your business only took $40,000 of CBEA loans, you’ll be able to take advantage of up to 25 percent (or up to $10,000) loan forgiveness.

In order to qualify for the loan forgiveness of up to $20,000 on CEBA loans your business must be in good standing with the Canada Revenue Agency (CRA). And you must repay a portion of the CEBA loan on or before the January 18, 2024 deadline.

CEBA loan forgiveness is determined by the amount borrowed.

CEBA loans of $40,000 or less you must repay $30,000 by Jan 18, 2024 to receive $10,000 of CEBA loan forgiveness. CEBA loans of $60,000 you must repay $40,000 to receive $20,000 of CEBA loan forgiveness. Note that any value of loan forgiveness is still subject to regular business taxes.

For the businesses that opted for the CEBA expansion, if you received a $40,000 loan and subsequently received the $20,000 expansion, the terms of your forgiveness have changed and are described by the Canadian government as follows:

Repaying the outstanding balance of the loan (other than the amount available to be forgiven) on or before January 18, 2024 will result in a single tranche of loan forgiveness up to $20,000 based on a blended rate:

— 25 percent on the first $40,000; plus

— 50 percent on amounts above $40,000 and up to $60,000.

For clarity, the portion of forgiveness based on a rate of 25 percent and the portion of forgiveness based on a rate of 50 percent are combined into a single tranche of forgiveness, which is only available if all other amounts outstanding are repaid by January 18, 2024. For example, if $60,000 is borrowed, no forgiveness is available unless $40,000 is repaid.

What kinds of business loans can Levr.ai help me with?

Levr.ai can connect you with the right business loan. Our trusted and verified lenders find you the loan that meets your needs - some of those options may include: business term loans, merchant cash advances, venture debt financing, accounts receivable financing, equipment financing, or SRED loans.